Where in the world is Jack Ma?

That question was on every investor’s mind back in November 2020.

Ma had founded Alibaba, the Amazon of China, 23 years prior.

Since then, he has grown into an icon in China’s tech industry and one of the country’s most recognizable figures.

However, Ma was beginning to get frustrated with the growing level of government interference in his business.

So he decided to make his feelings known in a speech at a Shanghai conference in October 2021.

He roasted those he called “pawn shop” Chinese lenders and regulators who don’t understand the internet.

A week later, Ma faced questioning by government regulators and seemingly vanished.

What followed was an immense crackdown on China’s tech sector.

Days after Ma’s speech, Chinese regulators nixed the planned initial public offering (IPO) of Ant Group. At a $34 billion value, it would have been the world’s largest IPO.

[An IPO is when a privately held company lists on a public exchange.]

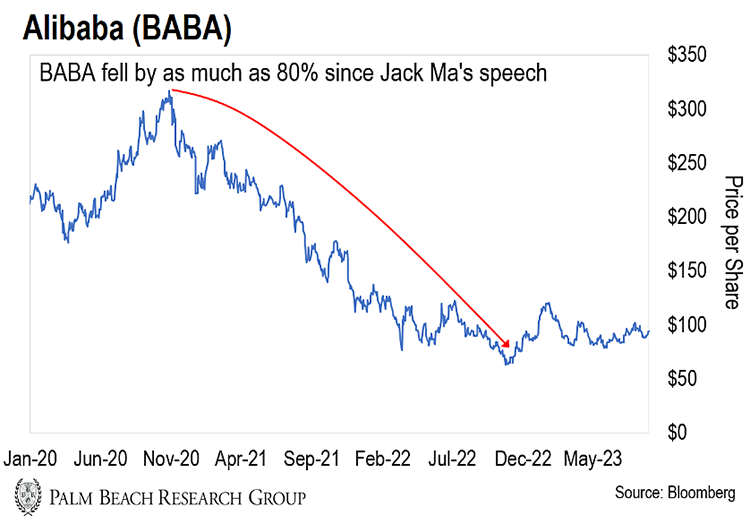

Since Ma’s speech to its October 2022 low, Alibaba’s shares fell by 80%.

Meanwhile, after vanishing for more than two years, the iconic Ma has finally reappeared… as a visiting professor of business at Tokyo College in Japan.

I’m sharing this as a warning…

Artificial intelligence (AI) is one of the biggest investing trends of our lifetime.

Investors are scrambling to get exposure to companies set to dramatically benefit from AI.

As a result, many are turning to Chinese companies like Alibaba, Baidu, and Tencent to get that exposure.

However, China is beginning to form regulations based on its communist principles around AI… And it’s clear these communist regulations will be a continuation of last year’s tech crackdown.

Today, I’ll walk you through what China is doing to regulate AI and why you should avoid Chinese AI companies.

I’ll finish today’s essay by sharing with you which AI companies to go with instead.

The Great Tech Wall of China

It should come as no surprise that China’s AI regulation hinges on state control.

China’s main regulatory agency overseeing AI is the Cyberspace Administration of China (CAC).

According to the CAC, the Chinese government sees AI as a strategic technology that can help it achieve its economic and geopolitical goals.

However, reports out of China show that regulators are concerned that AI services could generate content that goes against the government’s views.

New CAC regulations rolled out in July require a license from the government.

To obtain a license, companies must provide the CAC with the inner workings of the algorithms that will power the AI services.

According to the CAC, AI services must adhere to the “core values of socialism.”

If those algorithms don’t adhere to socialist values, they can’t offer AI products and services in the country.

If a Chinese company’s AI product is found to violate the CAC’s rules, then the company will have to rework its algorithms before resubmitting it for approval.

The issue is it’s possible to trick even the most carefully trained AI program into saying objectionable things.

Computer scientists call this phenomenon “AI hallucinations.” It’s when users are able to draw a completely false response from an AI bot like ChatGPT.

A popular meme currently going viral on Chinese social media shows Alibaba’s Tongyi chatbot being fooled during early trials.

A simple request of how to make a dish called “concrete stir fry” leads the bot to confidently lay out the best ways to prepare concrete for dinner.

Platforms like ChatGPT and Google’s Bard have yet to root out this problem, and they’ve been developing these capabilities for years.

So far, it’s clear that Chinese bots suffer the same issues.

This will cause many AI companies to have to go back to the drawing board when the government inevitably finds the chatbot saying questionable things.

And it will drive away the rest of the world.

People Around the World Don’t Trust Chinese Businesses

Alibaba, Tencent, and Baidu are all massively popular platforms in China.

However, they have virtually no popularity outside of China. Each of those platforms earn a tiny amount of revenue abroad.

This is due to a lack of trust of Chinese businesses and overall anti-Chinese sentiment.

According to a Pew Research survey of citizens of 19 developed nations, 68% of people have unfavorable views of China.

This plays a role in most Americans never purchasing items from Alibaba, or using Tencent’s video conferencing tools, or searching through Baidu. Most Americans probably don’t know they even have access to those platforms.

The CAC rule of collecting users’ identifying information won’t sit well with people around the world.

That will limit the growth of Chinese AI companies. It will also make them more vulnerable to downturns in the Chinese economy.

In contrast, American companies involved in AI like Microsoft and Alphabet generate half of their revenue abroad. That makes them less vulnerable to economic weakness in their home country.

Stick to Safety

Now, we’re not trying to discourage investors from gaining exposure to the AI trend. It’s going to be the biggest megatrend of our generation.

Consultant Firm PwC Global estimates it will create $15.7 trillion in new wealth.

We’re well positioned to capture that within our flagship The Palm Beach Letter with investments in Nvidia, Microsoft, and others.

However, as I said above, China has a history of meddling in its technology industry to the detriment of those companies and their investors.

Given its heavy-handed AI regulations, I expect the same to occur as companies try to roll out AI products.

And tech users around the world won’t download Chinese apps that prioritize communist values over privacy and usefulness.

So, I don’t recommend investing in Chinese companies like Alibaba, Tencent, or Baidu for their AI potential.

Instead, I recommend sticking with American companies on the front lines of AI development. Those include companies like Microsoft, Alphabet, Meta, and Nvidia.

However, these are already blue-chip companies. So while they’re a safe bet on AI, they also won’t see incredible returns.

If you’re looking for a company with more potential upside moving forward than the AI stalwarts, Daily editor Teeka Tiwari recently traveled to Arizona’s Sonoran Desert to research a key supplier of the AI megatrend.

Based on Teeka’s research, this company could end up supplying Tesla CEO Elon Musk with an essential piece of technology for his new AI venture. (He wrote more on this in last week’s Daily essay.)

And if you buy shares now, before Musk makes the official announcement…

Teeka believes you’ll have a chance to make incredible gains from a blue-chip stock.

Teeka just put together an investigative report on this huge opportunity. You can watch it right here.

Regards,

Michael Gross

Analyst, Palm Beach Daily