The U.S. economy is the largest in the world.

The gross domestic product (GDP) – the total of all the goods and services the country produces each year – tops out at $25.4 trillion. The next biggest GDP is China’s with $17.9 trillion. And third is Japan’s at $4.2 trillion.

But exactly how much money are we talking about here?

There’s no better way to understand the sheer volume of money than to show you…

You might have a $1 bill lying around. If so, grab it and put it on the table.

Stack 1,000 of them on top of each other, and you’d have a fat stack about 4.3 inches high – roughly the height of a toilet paper roll.

Stack 1 million of them on top of each other, and it would stretch the length of a football field (100 yards).

Source: Bing Image Creator

Now, stack 1 billion of them on top of each other, and congratulations – you’re well across the threshold that delineates Earth’s atmosphere from outer space.

Here’s where things start to get almost beyond the realm of comprehension…

One trillion $1 bills stacked on top of each other gets you about a third of the way to the moon.

But try 33 trillion of them – stacked one after the other after the other. That gets you right up to the moon and back almost five times over.

That’s further than all the human space flights Elon Musk has launched with SpaceX.

These numbers are frankly absurd.

They’re absurd because that kind of money – $33 trillion – is an absurd figure. It’s a volume of money that doesn’t (and never will) physically exist.

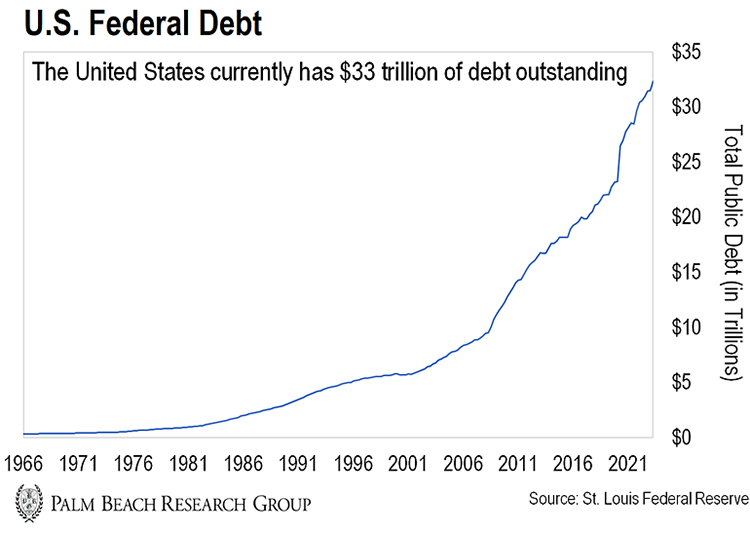

But it’s exactly the level of federal debt in the United States today.

Thirty-three trillion dollars isn’t “just a number.” It’s easily said and dismissed mainly because of the absurdity of such a figure.

But $33 trillion is the financial burden that you, your kids, your grandkids, and your kids’ grandkids will have to shoulder.

Friends, you already know the U.S. is in deep debt. So this is nothing new to you.

What you don’t know is an event guaranteed to happen this month could trigger what I call the Final Collapse of the U.S. dollar.

The Event Will Trigger the Final Collapse

The current interest rate on the benchmark 10-year Treasury note is 4.9%.

JPMorgan Chase CEO Jamie Dimon forecasts rates will rise to 7%. JPMorgan Chase is the largest bank in the United States, so Dimon knows a thing or two about these rates.

At 7%, the interest payments on $33 trillion would be in the vicinity of $2.1 trillion per year.

This level of debt is the endgame I’ve been warning you about… a “doom loop” that tips America over the edge from dollar superpower into dollar collapse.

It’s this level of debt – and the trillions more needed to service it every single year – that triggers de-dollarization.

De-dollarization is the world reducing its reliance on the U.S. dollar as a reserve currency. It would signal the decline of America’s position as a global financial superpower.

And the trend has already started…

Earlier this year at the World Economic Forum in Davos, Switzerland, Saudi Arabian Finance Minister Mohammed Al-Jadaan said his country would be open to other currencies aside from the U.S. dollar to improve trade.

This was no off-the-cuff comment. It was a follow on from Chinese President Xi Jinping, who said in December 2022 that the oil trade should be priced in Chinese yuan.

Brazilian President Luiz Inacio Lula da Silva called for the BRICS nations (Brazil, Russia, India, China, and South Africa) to create their own common currency at the BRICS Summit in Johannesburg just this August.

He said a common currency “increases our payment options and reduces our vulnerabilities.” In other words, it reduces their exposure to the U.S. dollar.

This is the reason the Treasury Department is about to face the music when it goes to market in just a few weeks to sell bonds to a world that’s starting to look for alternatives to the U.S. dollar.

To fund the government’s ongoing operations and the trillions in debt it continues to stack up, the U.S. Treasury will auction off a whole host of Treasury bonds and bills to the market later this month.

It does this just to pay the bills.

It seems like a good plan: Stack up debt, sell debt to pay for your debt… except the gigantic elephant in the room – what if there’s no one there to buy at the auction?

The government needs to sell hundreds of billions in its Treasury auction to fund its lavish lifestyle. But if it can’t… All hell could break loose.

The inability to sell bonds to service the absurd debt spiral means that Federal Reserve boss Jerome Powell and his minions at the central bank will have no other choice but to wind up their money printer again so it can pick up the slack in the U.S. Treasury bond market.

This will trigger what I believe will be the final collapse of the dollar’s purchasing power.

We’re starting to see a small version of that collapse unfold now…

In 2020, a McDonald’s Big Mac cost about $4.95. As of July 2023, a Big Mac costs $5.58. That’s a 12.72% rise in just three years.

If that sounds trivial, consider this…

At the beginning of 2020, the average U.S. house cost $300,000. Today, a home will set you back $425,000.

That’s a 42% increase in less than four years. Before 2020 it took nearly seven years to see that much growth in housing prices.

Now throw in mortgage rates that are almost five percentage points higher than two years ago, and you can see that – thanks to the erosion of the dollar’s buying power – home ownership will remain an unfulfilled dream for most Americans.

That’s what real-world inflation looks like.

It erodes your purchasing power. It reduces the quality of your life. It delays your most cherished hopes and dreams… like home ownership.

And the only way to beat it is to find some way to make a lot more income or find a way to have your investments outgrow it.

The Fed, via its money printing – which in turn fuels inflation – forces people into a corner.

Earn more or make more on your investments, or get poorer. It’s that simple.

The good news is it’s not all doom and gloom.

As I’ve predicted before, there will be one way to create moonshot wealth if you’re prepared to go out of your comfort zone and take action.

I’m talking about bitcoin (BTC).

Bitcoin Isn’t the Only Way to Protect Your Wealth

The Fed can print as many dollars as it likes… But the number of bitcoin will never exceed 21 million.

This preset scarcity (along with bitcoin’s security features) is why the crypto has wildly outpaced other investments over the past decade.

Longtime readers know I expect bitcoin to eventually hit $500,000. That’s a 1,320% gain from here.

So you should absolutely buy some bitcoin. It’s a terrific asset. But the biggest gains during this Final Collapse won’t come from bitcoin.

To help you prepare for this event, I held a special briefing on Wednesday called The Final Collapse.

During the event, I revealed the one asset that will skyrocket as the dollar’s purchasing power plummets.

The last time the dollar had a similar crisis, my readers had a chance to make 27 times…. 56 times… and even 850 times their money – in less than two years.

Friends, if you don’t want to see the money in your wallet, bank accounts and retirement accounts evaporate in value…

Then it’s imperative you click here to learn which asset class I believe will far outpace the declining purchasing power of your dollars.

Let the Game Come to You!

Big T