Yesterday, a friend asked me about two strong companies in the same industry. (I’ll call them Company A and Company B.) He wanted to know which of the two stocks I’d buy.

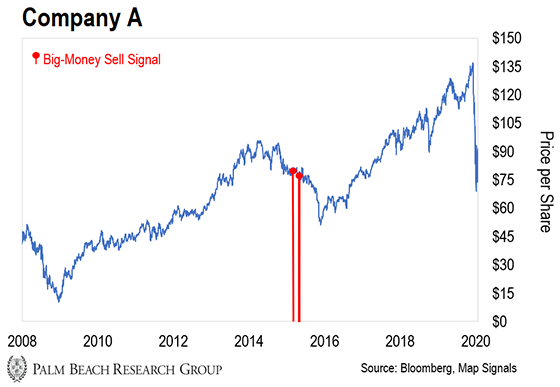

Now, take a look at the two charts below. They show the big-money buying and selling both companies have seen since 2008…

Even though Company A has better brand recognition, it’s a no-brainer to see why I chose Company B.

As regular readers know, I look for the best of the best stocks: high-quality companies growing sales and earnings, with little debt.

But I need to see more than just solid fundamentals. I want to see the big money piling in. You see, big-money buying lifts those stocks higher – which is why we want to follow it to profits.

So Company B was the obvious answer. The big-money buying it’s seen over the years is clear.

And this strategy is exactly how we can take advantage of an opportunity of a lifetime right now. I’m letting the big money show us the way.

So today, I’ll share where it’s headed today – and how it’ll help us profit during the current “Great Reset”…

I Was Right…

We’re living in unprecedented times.

Effects of the coronavirus pandemic ended the most spectacular bull market in history on March 11, 2020. It wiped out about $8 trillion of U.S. market cap.

Over the past few months, market volatility has been wild. Some stocks have zig-zagged 5% lower one day and 5% higher the next.

I know crashes like this are painful. That’s why I developed my “unbeatable” stock-picking system… to take emotion out of the equation.

I used my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – to make sure it’s highly accurate, comprehensive, and effective.

My system scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the buying and selling movements of big-money investors in the broad market.

And this data helps me update you every step of the way – especially in uncertain market conditions like we’re seeing now.

The thing about crashes is, bottoms are very hard to nail. But my system predicted this bottom almost to the day…

- On March 11, I told you my system forecasted the bottom would be around March 20.

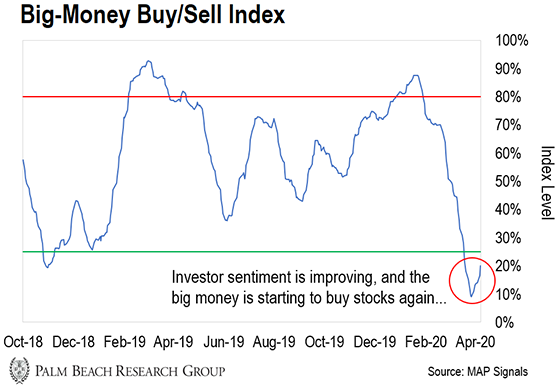

- Then, on March 19, my Big-Money Index (BMI) triggered oversold market conditions – which I mentioned the day before. (This is when the market is seeing extreme big-money selling.)

- And on March 23, we put in a short-term bottom.

So my system was only three days off. Since then, it’s correctly predicted the next market moves, too.

After the BMI hit 9% last week, I told you buying would start trickling in again soon. And while there’s still volatility, the markets have recouped some losses recently. In fact, the major indexes have all gained 9–10% since last Friday.

But timing the bottoms isn’t important in the long run. What you need to focus on is that these bottoms are the perfect time to buy…

The Great Reset Is Here

As I told you last week, I’ve waited over a decade for this huge money-making opportunity to appear again.

You see, during every crash, the market eventually hits a bottom. But these troughs don’t usually last that long.

And according to my research, the market rebounds an average of 13% within the next year. But some stocks rise even higher from this wreck… like phoenixes.

I’m talking about explosive gains of up to 7,037% from their bottoms with average gains of 2,505% (trough to peak).

That’s the Great Reset.

Now, you want to buy when the big-money selling reaches extreme levels and the market becomes oversold (like it has recently) or shortly afterwards. This gives you the chance to grab the best stocks at a discount.

The key is knowing which stocks to buy during this Great Reset. And that’s where my system comes in…

Following the Big Money to Profits

Again, my system’s data is indicating bullish moves in the near term.

As you can see in the chart below, the BMI is continuing to rise…

So the big money is finally starting to buy again. Investors are becoming less fearful. (The market’s “fear gauge” – the CBOE Volatility Index – has fallen from a high of over 82 on March 16 to around 43 today.)

And just like with Company B from earlier, my system will flag the stocks the big money piles into right now. If you want to learn how, just watch my special presentation right here.

It’ll show how you can profit from these “phoenix” stocks, too. You’ll definitely want to join me and my subscribers as they rocket higher during the market’s rebound.

Remember, things are looking up…

Coronavirus cases and deaths are beginning to peak. Some parts of the world will be able to reopen soon. And the work on a vaccine and treatment continues to move forward. Plus, there’s news of more potential market stimulus.

So there’s light at the end of this tunnel.

Patience and process!

Jason Bodner

Editor, Palm Beach Insider