To most investors, it must be difficult to pin down which stocks will be the biggest winners in 2021.

There’s no denying that the U.S. is in one of its most volatile periods since the early 2000s. While a pandemic rages across the country and political tension reaches new heights… investors watch the stock market trade at record highs.

These truths seem totally at odds with each other. And it makes sound investment decisions difficult to reach.

But here in Palm Beach Insider, we don’t rely on world events to guide our investments. We rely on the turning gears of the great financial machine… big money.

These heavyweight institutions and hedge funds have a firm grip on the market’s direction. And as we’ve shown in these pages, following it proves more profitable than any other strategy I’ve seen.

So in today’s issue, I’ll show you where the big money has its sights set for the coming year, and the best way to position yourself to profit…

Where the Gears of Wall Street Turn

To answer this question, let’s first break down how our big-money system works…

First, it scans over 5,500 stocks every day. It analyzes each one for fundamentals like great sales, earnings, and profits. It also looks at technical factors – how each stock is trading.

It ranks each one… and then overlays a special algorithm looking for when big money is moving in or out of the stock in an unusual way.

All of these signals combine to form the Big Money Index (BMI) – a 25 day moving average of big-money buy and sell signals that show us where things are likely headed.

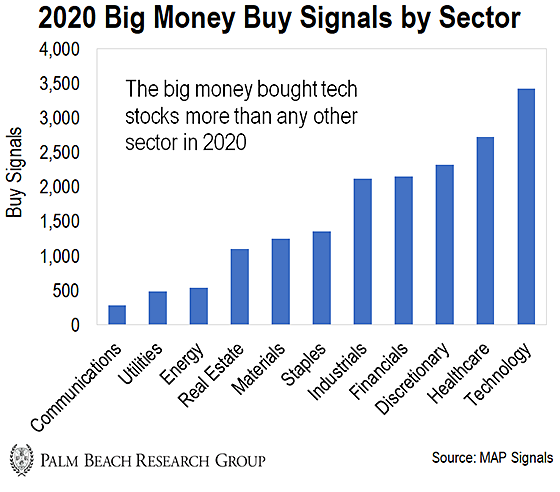

As we showed throughout last year, the big money was far more interested in buying than selling in 2020.

But where was that buying focused? When we break it down, we can clearly see where big money was focused: technology stocks.

I believe 2021 will see more monster buying in tech. But the trick is, of course, to know which tech stocks to lean into, and which to avoid. And right now, the old standbys of the tech world are facing major headwinds…

Big Tech’s Big Problems

Big tech is in a shaky spot right now. With the recent siege on Capitol Hill, the president is in the crosshairs of big tech. Facebook, Twitter, and Amazon have all effectively gagged President Trump – in their words, as an attempt to prevent any further unrest.

Whether or not you support these platforms banning the president, the fact is these bans are troubling. Yes, these are private companies that can do whatever they want. There is no technical violation of the First Amendment here.

But it is un-American to prevent speech that’s at odds with an individual opinion. We live in a land of free speech. Granted, there are dangers possible when speech can elevate violence, but widespread gagging is not ideal – nor is it the American way.

And it’s clear to see how plenty of people feel strongly enough about this to stop using these big tech services, and search for alternatives. This is just one reason why I see near-term headwinds for big tech.

Plus, there’s the problem of what I call the “ceiling effect.”

Think about this… We just saw the first company hit a $1 trillion market cap only a couple years ago. There won’t be many more companies to grow to that level anytime soon.

Compare this to the abundance of companies worth less than $10 billion that could easily grow to $100 billion or more…

So, big tech may face near-term headwinds due to the political climate, and longer-term ceiling restrictions. But there are pockets of tech where I see great opportunity…

The Biggest Opportunities in Tech Right Now

In my research, I uncovered something startling about the tech sector…

50% of all tech buy signals last year – and 10% of all stock buy signals – were in software stocks. This trend should only continue as software powers the world. Tech savvy or not, we all rely on software to help us do our jobs and go about our lives.

Investors seeking broad exposure to the software sector might consider an ETF like the iShares Expanded Tech-Software Sector ETF (IGV).

I’m also seeing huge big-money moves coming into the digital payments space. With industry stalwarts embracing cryptocurrency, and pioneering secure digital payments for our online world, cash is increasingly becoming a thing of the past… and right now, there’s just no reason to believe cash suddenly resurges in popularity again. Investors seeking broad exposure to digital payments might consider an ETF like the ETFMG Prime Mobile Payments ETF (IPAY).

And finally, consider semiconductors. Semiconductors are the hardware that powers all the above innovations. The chipmakers and component manufacturers are continually striving to keep up with demand. With ever more mobile devices proliferating the market, demand continues to soar for faster and better chips. Investors seeking broad exposure to semiconductors might consider an ETF like the iShares PHLX Semiconductor ETF (SOXX).

Tech collected much of the big money last year and is poised to do so again in 2021. But be careful where you place your bets…

I like to bet alongside big money, and last year they loved software. Digital payments was an active space too. And the tech that powers it all is faster and better chips: semiconductors.

At the same time, the old big tech standbys may have stormy weather in their forecast for the near future.

As always, I’ll let big money be my guide. It’ll be interesting to see how 2021 unfolds, but looking through the big money lens, I have my eye on software, semis, and payments above all.

Patience and process!

|

Jason Bodner

Editor, Palm Beach Insider