Louis Navellier is one of Wall Street’s renowned fund managers. He’s the chairman and founder of $2.5 billion investment manager Navellier & Associates.

He’s also my good friend and mentor. And one of his wisdoms that’s stuck with me is, “Bad stocks bounce like rocks, and good stocks bounce like fresh tennis balls.”

It rings even truer after market crashes.

You see, during the Great Reset, the high-quality stocks will bounce back even higher when the market rebounds. But others will fall flat – like sandbags dropped from a roof.

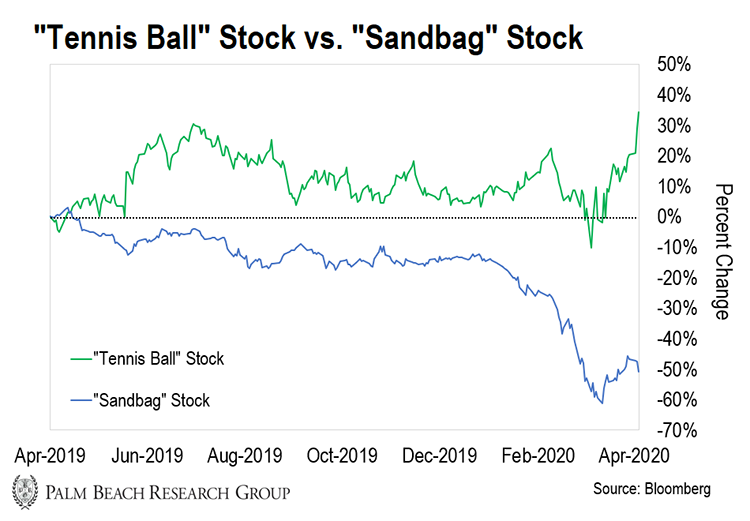

Just take a look at the performance of the two stocks below…

The “tennis ball” stock has bounced back 48.3% since the coronavirus-related market crash. And it’s up 8.7% from its February 2020 highs.

But while the “sandbag” has regained 26.7% since the crash, it’s still down 36.5% since February.

I’ll reveal both stocks below. But which would you rather own?

The answer is obvious to me. So today, I’m going to take a break from all the negative coronavirus pandemic news.

Instead, I’ll show you how to find the stock market’s tennis balls – and avoid the sandbags – during this Great Reset…

The Great Reset

If you’ve been following me the past few weeks, you’ve heard me talk about the Great Reset. I’ve waited over a decade for this huge money-making opportunity to appear again.

You see, during every crash, the market eventually hits a bottom. But these troughs don’t usually last that long.

And according to my research, the market rebounds an average of 13% within the next year. But some stocks rise even higher from this wreck… like phoenixes.

I’m talking about explosive gains of up to 7,037% from their bottoms with average gains of 2,505% (trough to peak).

That’s the Great Reset.

Now, you want to buy when the big-money selling reaches extreme levels and the market becomes oversold (like it has recently) or shortly afterwards. This gives you the chance to grab the best stocks at a discount.

The key is knowing which stocks to buy during this Great Reset. And that’s where my system comes in…

Green Means Buy, Red Means Sell

A 2017 study by an Arizona State University finance professor found that… over the past 100 years, just 4% of stocks have accounted for nearly all of the market’s profits. And only 1% of stocks have accounted for nearly 50% of the gains.

I call these stocks outliers.

They’re companies with unique businesses and big profit margins that grow sales and earnings at high rates. And their stocks can return 10x, 100x, or even 1,000x your money. (Think of Amazon or Google.)

But here’s the best thing about outliers…

After market crashes, they bounce back like fresh tennis balls. (Or as I like to say, they rise from the ashes like phoenixes.)

Take Amazon, for example. It’s already back to all-time highs, despite plunging 22.7% during the bear market crash. That’s a phoenix stock.

Now, I became obsessed with these kinds of outliers since 2001. And I’ve devoted my life to finding them.

To sniff them out, I created my “unbeatable” stock-picking system that follows the big money’s movements.

I used my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – to make sure it’s highly accurate, comprehensive, and effective.

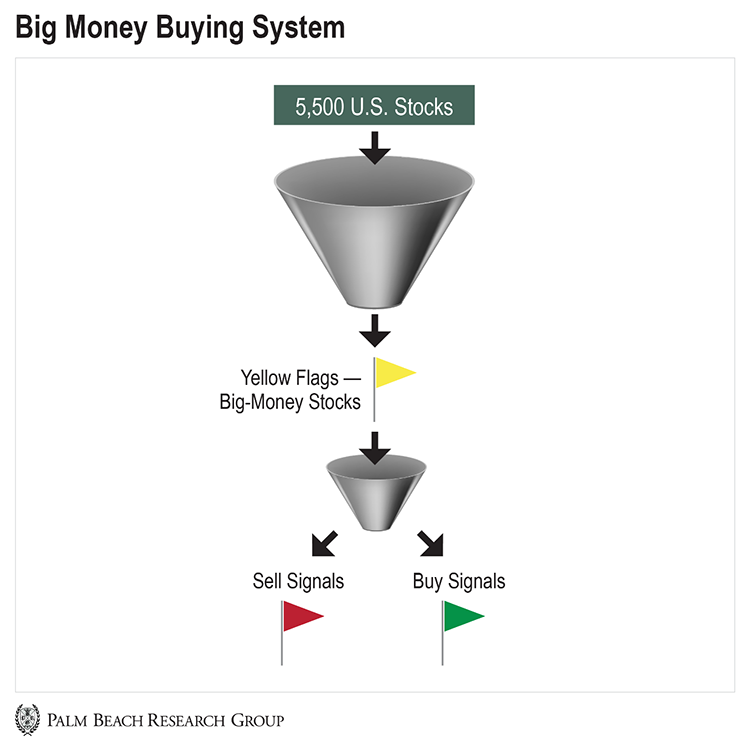

It scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors. And when it sees them piling into or getting out of a stock, it raises a yellow flag.

I put these yellow flags through another filter. If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

It’s that simple: When I see green, the big money is buying.

Where the Big Money Is Headed Now

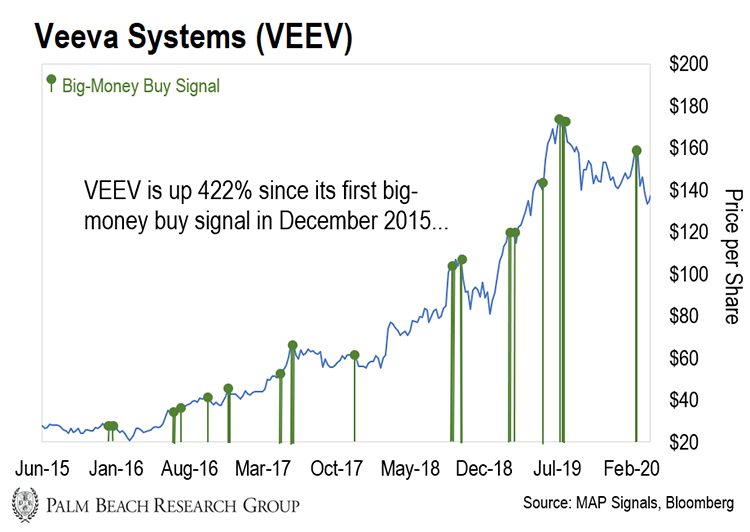

Remember the “tennis ball” stock from the chart above?

It’s health information services company, Veeva Systems (VEEV).

My unbeatable stock-picking system identified the big money piling into the stock. And here’s the chart I showed my Palm Beach Trader subscribers after I recommended it to them on March 17…

Since then, it’s up around 42% in less than a month, while the S&P 500 is up only 16% in the same time frame. That’s the power of buying phoenixes during the Great Reset.

(Note: VEEV is above its buy-up-to-price, so I don’t recommend buying it now.)

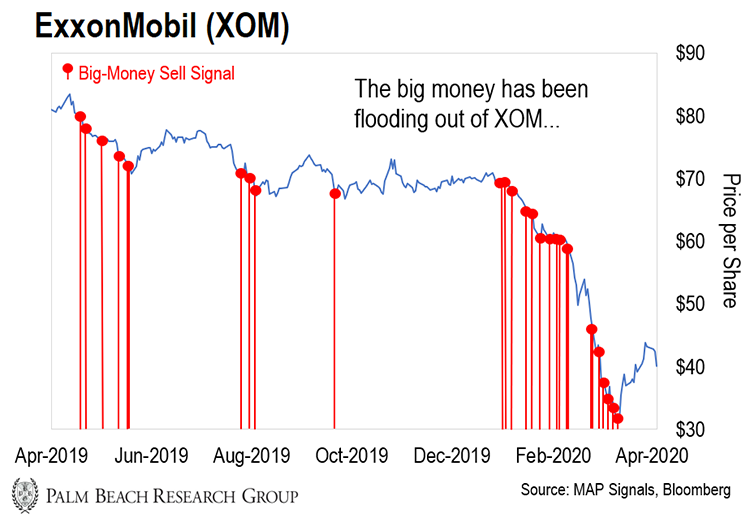

And the “sandbag” stock?

It’s energy giant ExxonMobil (XOM). As you can see below, my system is showing that the big money is fleeing the stock in droves…

But this shouldn’t come as a surprise…

The Global Industry Classification Standard (GICS) sorts the 11 sectors making up the S&P 500. Each sector is broken down by industry group, industry, and sub-industry.

And the table below ranks the 11 GICS sectors based on their strength, as measured by my system. The higher the number, the more buying the sector is seeing – and the stronger it is…

| Sector | Strength Ranking |

| Information Technology | 59 |

| Health Care | 58 |

| Utilities | 56 |

| Consumer Staples | 55 |

| Industrials | 52 |

| Materials | 50 |

| Real Estate | 50 |

| Financials | 48 |

| Consumer Discretionary | 47 |

| Communication Services | 45 |

| Energy | 45 |

Right now, big money is avoiding the energy and communication services sectors. And so should you.

Don’t get lured into energy companies just because their prices look cheap. They’re more than likely a value trap – and sandbags.

Instead, if you want to make money during the Great Reset, consider buying outliers in the information technology and health care sectors. They’ll bounce back like fresh tennis balls.

And to learn more about how my system identifies outliers and phoenixes – like VEEV – just watch my special presentation right here. You won’t want to miss out on their gains as they rocket higher.

Patience and process!

Jason Bodner

Editor, Palm Beach Insider

P.S. As I mentioned above, VEEV has rallied so much, so quickly… that it’s already out of buy range in my Palm Beach Trader portfolio.

But my “unbeatable” stock-picking system recently flagged several other stocks to buy during the Great Reset. And it’ll continue to do so as the market rebounds.

Like VEEV, I expect them to rise like phoenixes as this market rebounds. So to learn more about how you can access them in Palm Beach Trader, click here…