As we enter the home stretch of a volatile year in the market, many investors still haven’t caught on to a painful truth…

Inflation will run higher and longer than expected.

Although there’s finally been a year-over-year drop in inflation, it’s still running hot at over 8%… And bond yields are barely topping 4%.

Inflation is so hot that the Federal Reserve’s moves this year – which have simultaneously crushed the bond and stock markets – haven’t been enough.

So it’s almost guaranteed we’ll see higher Fed rates going into the end of the year.

And it’s not just the United States…

Countries like Sweden and England are dealing with their own inflation woes… with the Eurozone hitting its own 9.1% inflation record.

So it’s time for an honest assessment of why inflation is running so high… why it will run higher than expected for longer than anticipated… and what investors can do today to protect their purchasing power.

Because doing nothing can be just as bad as investing in the wrong asset.

With high inflation, you’ll continue to lose purchasing power, whether you keep cash in the bank… or in declining stocks or bonds.

That’s why you need to pivot to assets that provide real returns above today’s high inflation.

Why Inflation Exploded Higher

Let’s start at the beginning with the simplest explanation for inflation.

Legendary economist Milton Friedman once described inflation as “always and everywhere a monetary phenomenon.”

And the past few years of massive money printing have shown this is largely true.

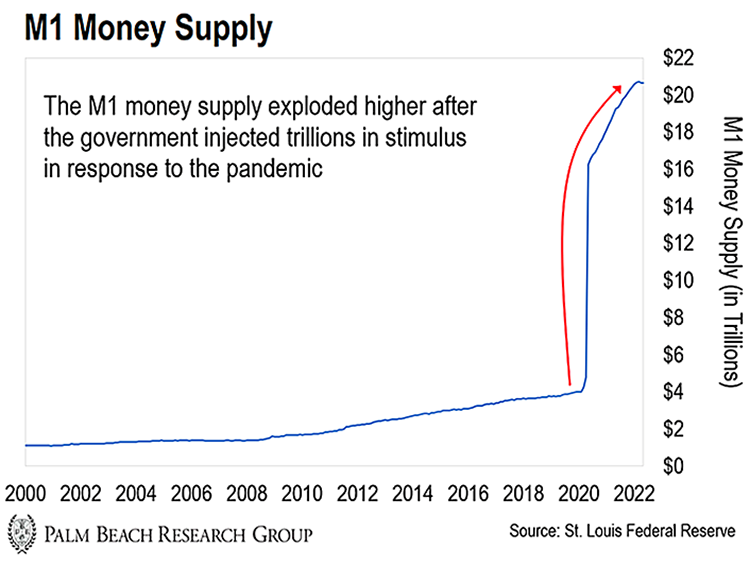

The chart below shows the M1 money supply – the measure of the total amount of money in circulation – as calculated by the government.

M1 money supply includes physical cash and cash equivalents like bank account balances. So as more money gets printed and injected into the economy, inflation rises.

And while the rate of money being handed out has slowed since the pandemic began… we’re still seeing several states using their funds to provide “inflation checks” to offset higher prices.

This creates a vicious cycle…

When you hand out checks to help people with higher prices, you stimulate demand, which keeps prices high.

Higher prices lead to more stimulus checks and money printing… which leads to more inflation.

Throw in federal legislation like the Inflation Reduction Act, which will spend billions of dollars to try and fight a problem driven by spending… and it doesn’t take a Ph.D. to understand things will only get worse.

The fact is that governments pushing stimulus policies just don’t get it.

Inflation remains a monetary phenomenon. And with a current U.S. federal deficit of over $1 trillion, the government still needs to print money… even as the costs of financing that deficit are soaring thanks to higher interest rates.

But there’s another factor at play that will keep inflation running higher for longer.

It’s not monetary, but it does have a political angle… which means politicians have found a way to throw money at it, too.

It’s called “Deglobalization.”

Deglobalization Will Keep Inflation Higher For Longer

It’s no secret that supply chains remain snarled.

The world spent decades building up a robust global supply chain… It was designed to be efficient and get goods where they needed to be “just in time.”

But the “just in time” model isn’t working today.

China is shutting down manufacturing centers at a moment’s notice for a mere case of Covid-19… Shipping delays backup ports, which have limited loading and unloading capacity at any given time.

And Companies like Apple (AAPL) are shifting production out of China, which creates more delays – at least in the short term…

So after decades of globalization pushing toward more efficient production systems, that process has stalled out.

Overall, this deglobalization trend may mean the inconvenience of some empty store shelves… Or having to pay surcharges on shipping to get something you need.

But it will ultimately mean a costlier global supply chain.

Yes, production will be closer to home, which sounds more efficient. But it will be in a higher-cost labor market.

That will drive costs up over time and create more inflationary pressure on top of good old-fashioned money printing.

Fortunately, there are ways for investors to protect themselves from inflation… investments that are unaffected by supply chain delays, runaway money printing, and even prolonged bear markets…

I’m talking about collectibles.

Own a Ferrari for Just $10

Collectibles are a key part of the Palm Beach Letter alternatives portfolio, which we expanded when we simplified our asset allocation model in July.

In today’s high-inflation market, alternatives like collectibles can give you higher returns over time, often with lower volatility.

That’s particularly true for real, rare, and enduringly desirable collectibles.

And collectibles have been setting new records this year while conventional assets like stocks and bonds have suffered massive losses.

For example:

-

A game-worn Michael Jordan jersey set a new record with a $10.1 million sale.

-

A Mickey Mantle rookie card sold for $12.6 million.

-

Andy Warhol’s “Sage Blue Marilyn” painting sold for $195 million at auction.

Best of all, you don’t need to buy a flashy sports car or expensive Rolex to take advantage of their inflation-busting benefits.

Collectibles platforms like Rally allow you to make fractional investments in rare cars, fine watches, sports memorabilia, and even dinosaur skeletons… just like buying a company’s shares.

These platforms do the research to weed out forgeries and find a good deal on a trophy asset… with many of their offerings being sold a few years down the line for a solid profit.

Best of all, these platforms allow you access to higher-level collectibles than you’d buy out of pocket yourself.

It’s an easy and affordable way to own truly rare, real, and enduringly desirable assets with the best appreciation potential over time.

Today, Rally has more than 400,000 users. And you can buy a fraction of world-class assets like a Ferrari or Warhol painting for as little as $10 per share.

A modest investment across a variety of collectible assets on the platform can go a long way to adding this unique and high-growth asset class to your portfolio.

Inflation isn’t going away any time soon…

So while the government hands out checks and passes billion-dollar spending bills, collectibles offer a way to invest in assets unaffected by Fed rates and broken supply chains.

Consider adding some to your portfolio today… and in tomorrow’s Daily, I’ll tell you about the key to obtaining the best returns when investing in collectibles…

Good investing,

|

Andrew Packer

Analyst, Palm Beach Daily

P.S. Collectibles aren’t the only way to beat inflation now… the right income-producing cryptos can create massive streams of income from a small initial investment.

That’s why Daily editor Teeka Tiwari recently told readers about a crypto catalyst that has him extremely bullish about bitcoin for the first time this year.

And investors that prepare for it now could have a shot at collecting a five-figure monthly income from just a handful of cryptos.

You can watch a replay of Teeka’s event right here… but don’t wait.

This catalyst has already been triggered, so this video won’t be online much longer.