The Fed will pivot in 2023. At least, that’s what investors expect.

But be careful what you wish for…

In Wall Street speak, a pivot simply means that our economy – held hostage by Fed Chair Jerome Powell – will stop being at the mercy of high interest rates. They’ll peak this year and likely decline.

The Fed hasn’t admitted it yet. In its December minutes, the central bank said it expected no cuts this year.

But investors are waiting with bated breath. Declining interest rates mean a lower cost of capital for borrowers. And that’s generally bullish for stocks.

It also means bond prices will start rising, not falling.

Interest rates are the Fed’s biggest policy tool… but naturally, every problem looks like a nail to a man with a hammer. And the Fed is willing to bludgeon the economy to nail inflation.

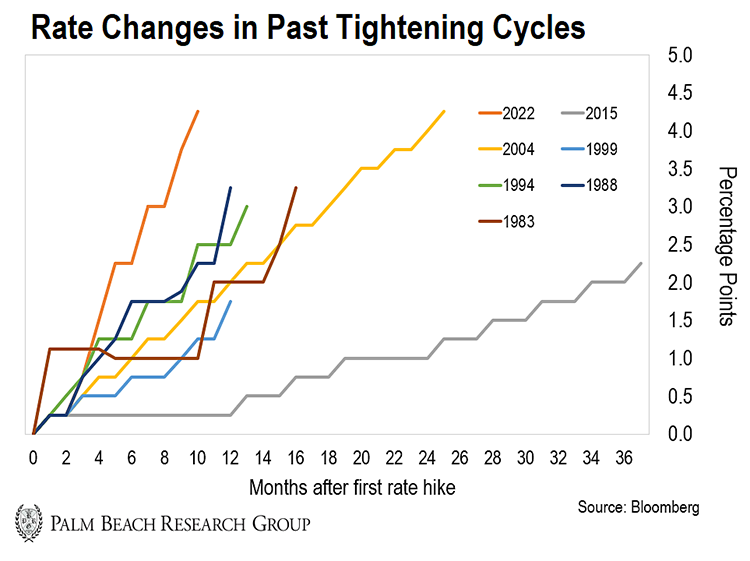

Since last April, interest rates have gone from zero to around 4.25–4.5%. That’s the fastest increase in the past 40 years…

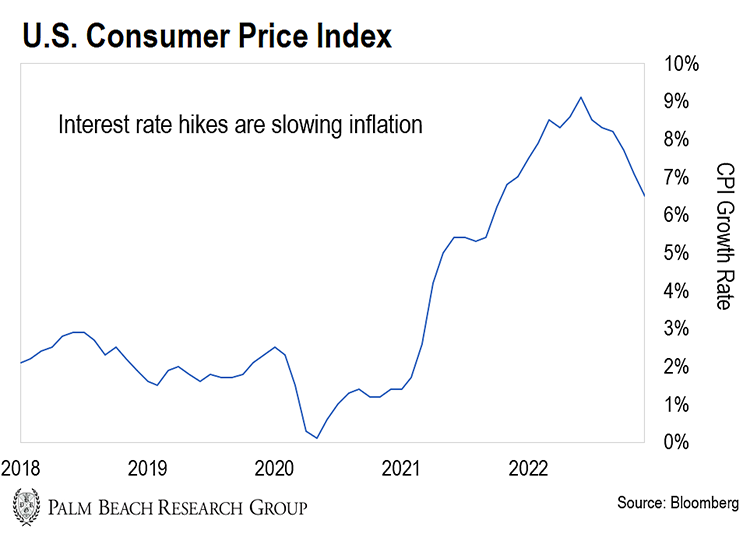

So, of course it makes sense that investors expect a pivot. Rates have gone up quickly, and inflation now shows a year-over-year drop.

Last Thursday’s newest Consumer Price Index numbers showed 6.5% year-over-year inflation through December 2022.

But while current economic conditions favor a Fed pivot… history shows it could prove mixed at best… and painful at worst.

That’s because it depends on why the Fed decides to pivot.

Let me explain…

History Isn’t on the Fed’s Side

While it’s not entirely its fault, the Fed’s record regarding pivots is embarrassing.

The central bank was created to act as a lender of last resort and protect the dollar’s purchasing power.

Add in the later addition of the Fed’s mandate to keep employment strong, and you’ve got a series of goals at odds with each other.

As Daily editor Teeka Tiwari explained yesterday, the Fed wants to create unemployment at a scale sufficient enough to slow down the U.S. economy, which he believes will bring inflation under control.

The last two times the Fed faced this dilemma was in 2007 and 2019. And each time, things got worse before they got better.

In 2007, the rumblings in the subprime market led to slower growth. But we were told the Fed had it contained, with then-Fed Chairman Ben Bernanke somewhat infamously stating:

Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited.

But the mess wasn’t contained, and Bernanke missed the mark by about 15 years…

Banks sliced and diced up mortgages, and the toxic mess went everywhere.

The Fed cut interest rates to zero for the first time in history, and it took years for the economy to come back from the brink.

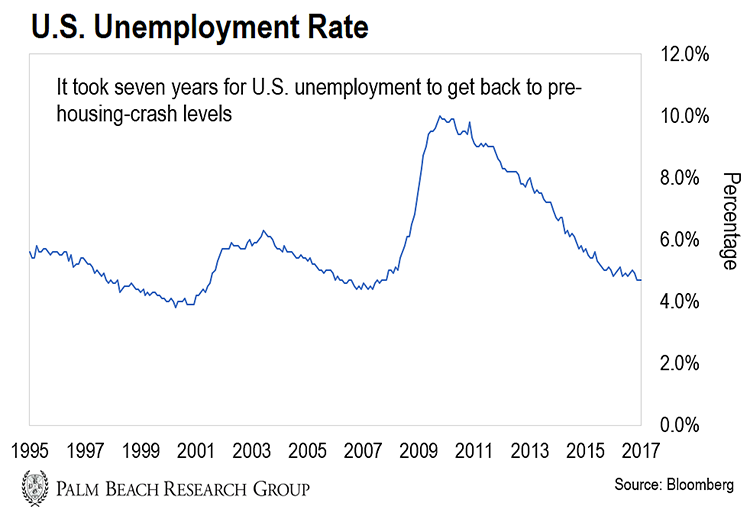

Unemployment soared higher than during the tech bust (as shown in the gray areas of the chart below).

It peaked in 2009 and took until 2016 to get back to pre-housing-crash levels.

Home prices likewise took several years to recover. Stocks recovered faster, thanks to low interest rates making them look like a comparatively strong investment.

Again, all that happened after the Fed finally made its pivot…

Even after it took those extreme measures amid a meltdown in September and October 2007, the market continued to trend down for another six months.

The next time a crisis occurred, the Fed used the 2007 playbook. But instead of taking 18 months to roll it out gradually, they did it in two weeks.

This second pivot started in late 2019 before Covid was a household word. But with a slowing economy and inverted yield curve… the signs of a crisis were there.

We’re just starting to see the long-term effects of that Fed pivot today. The economy got overstimulated – partially from low interest rates and partially from massive fiscal stimulus.

The biggest impact this time can be seen not with housing or unemployment… but with inflation. The Fed’s sharp rise in interest rates is starting to impact year-over-year numbers.

But massive government spending keeps a thumb on the scale of inflation.

That lessens the Fed’s ability to get prices under control. And higher interest rates are a bludgeon for the economy rather than a targeted tool.

The Pivot of 2023

With those last two pivots in mind… investors may not be too happy when the next one happens.

These pivots occur at pain points in the market. And they can take years to unwind the excesses that they cause.

The only “good” news is that they tend to help asset prices recover. The “bad” news is that you may be out of a job, house, or paying more for everything.

As Teeka recently pointed out, the current market decline isn’t that bad compared to prior crashes.

It’s certainly a walk in the park compared to the 80% dive the Nasdaq took after the tech bubble crashed in 2000.

The fact of the matter is… the Fed may be setting up for a pivot, but only if a crisis erupts, likely in the credit markets.

Why? The Fed has raised interest rates so far and quickly that some key financial institutions may become insolvent or even bankrupt.

That could lead to another 2008-style meltdown if it spreads.

We’ve already seen initial rumblings of such a credit crisis. In September, the Bank of England shelled out about $73 billion to shore up its pension funds.

The sudden jump in bond yields in the U.K. – and falling prices – led to those troubles… And it’s because they overleveraged on supposedly “safe” government securities.

It was the soundest course of action in the low-yield world that existed until last year.

I’ll admit… the possibility of a big meltdown is small. But it’s there.

And last year’s market decline could repeat itself over a much shorter window if it happens.

That’s why you need to prepare yourself.

The best preparation is to increase your cash holdings. The more you have in cash, the less you have in risk assets.

And with interest rates rising, holding cash isn’t as penalizing as it has been in the past.

There are several ways to increase your cash position without selling everything.

You can take profits on positions that have a big runup, for example… Because as soon as you’re playing with the house’s money on a trade, you’ll be in great shape.

In a bear market like today’s, you can also raise some cash by implementing tighter stop losses on positions.

And it doesn’t hurt to sell speculative positions or to let cash accumulate from dividends and interest on existing holdings.

I know this all sounds scary… but it’s an opportunity for those who are patient.

You see, 2023 is on track for fantastic discounts on shares of great companies and high-grade corporate bonds…

The Fed’s current policy of rising interest rates is leading to the best prices for bonds in nearly 15 years. And it’s taken the wind out of high-flying tech stocks while giving value-oriented investments a chance to shine.

The Fed’s slowing pace of rate hikes makes it likely rates will be higher for longer, so there’s little chance of missing a bargain-buying opportunity like in March 2020.

But by the latter half of the year, the Fed will likely decide it’s done raising interest rates any further.

The pause will provide a fantastic wealth-creating opportunity for investors in stocks and bonds.

But if the Fed has to pivot for any reason… you may have a few more months of pain before asset prices recover.

Regards,

|

Andrew Packer

Analyst, Palm Beach Daily

P.S. Holding cash is one of the best things you can do right now… We don’t know when the market will recover, and it’ll be a bumpy road until things cool.

But if you’ve got some extra cash on the sidelines, there’s a volatility-proof sector of the market that’s outperforming traditional assets…

And it’s one Teeka has watched explode in his own portfolio over the last two years.

It’s not crypto, bonds, or pre-IPOs… and you can get started today for as little as $50.