It’s no secret that the coronavirus pandemic has been devastating to many people. These unprecedented times aren’t easy.

But the media are also fanning the flames of fear.

You see, they’re in the business of selling ads. And they know people are drawn to negative stories more than positive ones. So they’re incentivized to scare you.

Just take a look at some of the recent headlines on the market:

-

“Stock market rally fizzles out,” CNN

-

“U.S. Economy Slumped in the First Quarter,” The New York Times

-

“Not Your Usual Spring as Crisis Continues, With Dismal Data Seen Ahead,” Forbes

But we haven’t been focusing on this doom and gloom. And as a result, we’ve done a great job of weathering the worst crash in our lifetimes…

In fact, through the massive sell-off, subscribers to my Palm Beach Trader service are sitting on a portfolio win rate of 81%, with average gains of over 40%.

That’s the power of ignoring emotions and listening only to what matters: the data.

So today, I’ll continue to share how the numbers are still proving the headlines wrong – and show you why it pays to bet on America’s recovery…

Tuning Out All the Noise

As you know, I specifically created an “unbeatable” stock-picking system to tune out panic. It focuses on market data by following the big money’s movements.

Using my experience from nearly two decades at prestigious Wall Street firms – regularly trading more than $1 billion worth of stock for major clients – I made sure it’s highly accurate, comprehensive, and effective.

Now, my system scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. But it doesn’t just look at individual stocks…

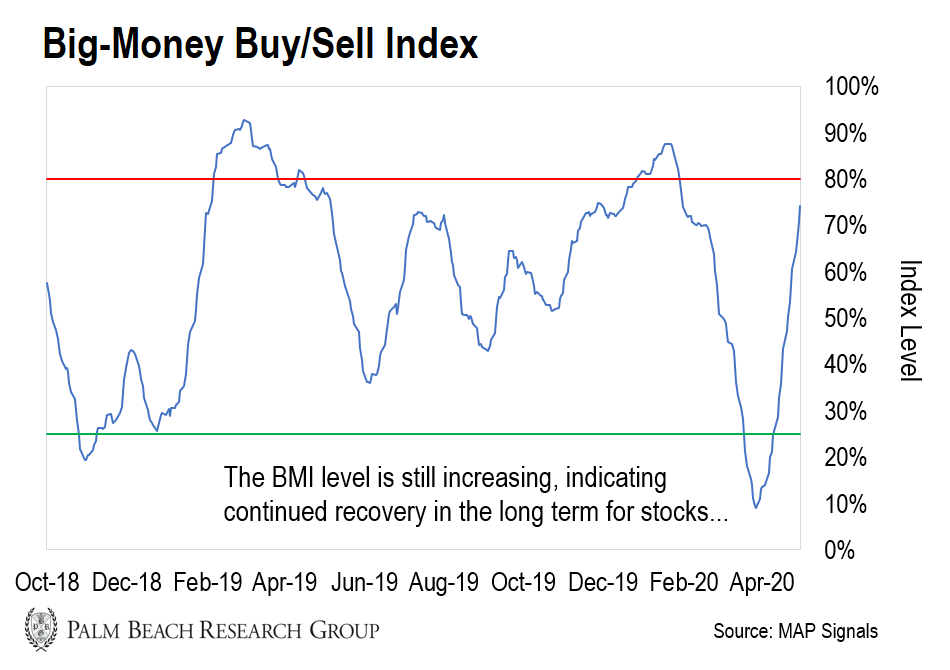

It also tracks big-money buying and selling in the broad market through its market timing indicator, the Big-Money Index (BMI).

The BMI data is so accurate, it forecasted nine market moves during this pandemic-related sell-off – including the March 23 bottom almost to the day… and the over 26% rally since then.

And right now, the index level is still increasing…

When it hits 80% (the red line in the chart) or more, it means buyers are in control and markets are overbought. And when it dips to 25% (the green line) or lower, sellers have taken the reins, leading the markets into oversold territory.

Since selling has already evaporated, this rapid rise to 74% is thanks to how fast our rebound from lows has been. But the long-term market uptrend is likely to persist.

Here’s why…

I’m Betting on America’s Reopening

You see, Wall Street is forward-thinking. It’s not pricing today, but tomorrow.

It’s already priced in the negative effects of the pandemic – which is why the bottom is in the rearview.

But now, the big money is expecting businesses to start opening again and a coronavirus treatment to make progress. It’s betting on an overall path to recovery beginning.

That’s why, despite lower earnings and GDP reports, we’re seeing the rally continue. This isn’t just a dead-cat bounce.

So here’s what I see ahead…

-

May–June: We’ll see a soft opening for a lot of smaller businesses. People will start to go out.

-

July–September: Things will start to get back in full swing. We’ll see signs that most of the economy is back at its capacity.

-

December 2020–March 2021: We’ll see a real return to normalcy. In March 2021, year-over-year comparisons will be phenomenal.

Remember, I said I was betting on America. And you can see that Wall Street is now, too.

This Great Reset is a huge money-making opportunity that I’ve waited over a decade to see again.

We just need to be patient as the big money floods in with buying again. When it does, we’ll profit from the highest-quality companies helping America recover from this crisis.

Patience and process!

Jason Bodner

Editor, Palm Beach Insider

P.S. Again, to truly profit during this recovery, you have to target the tennis-ball stocks – the ones that’ll rebound even higher than the broad market.

And my system can help you find them.

It’s already recently identified several winners for my Palm Beach Trader subscribers. That’s why we have an 81% win rate with 40% average gains, even through this crisis.

So don’t miss out on the next tennis ball to profit from. You can join us on finding it next right here.