Technology has changed the world around us. Many industries are hardly recognizable compared to what they were a few decades ago. And these dramatic shifts have always created a unique opportunity for investors to profit…

Consider the travel industry as an example.

Up until the mid-1990s, you’d visit a travel agency when you wanted to take a trip. An agent would help you book flights, a hotel, a rental car, and any other accommodations required.

But today, that hassle is gone. Booking tickets for a trip is as simple as going online. Sites like Kayak, Expedia, Hotwire, Tripadvisor, and Priceline make it easy to plan out a vacation or business trip in a matter of minutes. They also allow customers to shop around and ensure they get the best deal.

And the travel industry felt the impact of this shift…

In the late 1990s, there were around 45,000 brick-and-mortar travel agencies across the country. But in the years since, they’ve been reduced to just 14,000 agencies. That’s about a 69% decline.

But the companies that understood the tech trend taking place experienced a huge boom…

Booking Holdings (BKNG) – which owns Priceline, Agoda, Rentalcars.com, and Kayak – has seen its stock rise more than 33,500% since the early 2000s.

Investors who got in early could have made a fortune as the travel industry went digital.

It’s an example that shows the potential of something I call a “digital leap”…

From Analog to Digital

When an entire industry goes from analog to digital, investors have a rare opportunity to profit. In fact, I believe that digital leaps are the most lucrative events in the history of the stock market.

That’s because while some companies will stumble during the digital leap… others can skyrocket as the industry evolves with bleeding-edge technology.

And we’ve seen this play out in a number of digital leaps over the years…

Think about when it became possible to buy music with the click of a mouse. With the iTunes store, people could download their favorite songs for just 99 cents each. And as a result, Walkmans and CDs quickly became obsolete, replaced by the iPod and other digital devices.

And in the time since, we’ve shifted even further to streaming our music from services like Apple Music and Spotify. In 2020 alone, streaming services generated over $10 billion in revenue.

That’s a massive shift…

And while no one likes thinking about taxes… consider the change we’ve seen in this industry in recent years.

While many people go to tax professionals or do their taxes themselves, this industry has seen a huge digital leap with the rise of online services like TurboTax. In fact, a 2020 survey reported that 51% of respondents planned to file using online tax software.

As a result, Intuit (INTU), which owns TurboTax and other popular financial software, has risen more than 14,000% since its IPO.

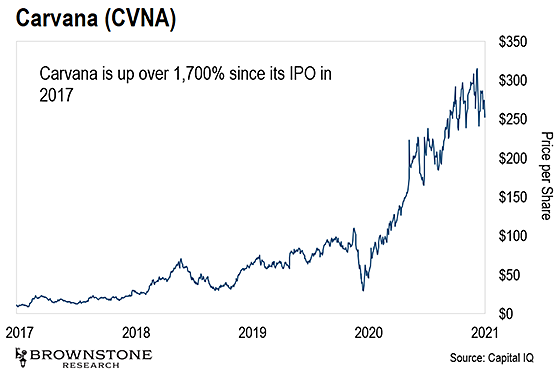

Another example is a company like Carvana, which is digitizing car sales.

Instead of going to a dealership and dealing with a salesperson, Carvana’s customers can simply go online to pick out and pay for a car. Carvana will then deliver your new car to your door and – if you’ve requested a trade-in – pick up your old one.

You can see the results of this digital leap in Carvana’s stock price. It’s up over 1,700% since its 2017 IPO.

These kinds of digital leaps are making our lives better… and they are giving us the opportunity to profit.

As these examples show, the gains can be incredible. And they’re made possible when an industry begins taking advantage of bleeding-edge tech. That’s why I want to make sure my readers are prepared for a digital leap that’s just now in its beginning stages…

The Last Digital Leap

While most sectors have already experienced a digital leap, a giant $11.9 trillion industry has been bogged down by government bureaucracy and red tape… until now. The pandemic has given this industry a huge boost, and it’s finally making its move.

As investors, we need to pay attention… because this could be the last digital leap we see.

That’s why I want to make sure we don’t miss out.

Now is the time to get in position… And I believe I’ve found the best company to take advantage of this trend.

It has 386 patents to protect its breakthrough tech… and it’s even collaborating with Microsoft.

Even more exciting, it’s on the cusp of making a major announcement in the coming months, and there’s no telling how high shares could go when that occurs.

If you’d like to find out all the details, tonight I’m hosting a free event called America’s Last Digital Leap. There, I’ll tell you all about which industry is preparing for this leap… and my top recommendation for how to profit.

So click here and join me TONIGHT at 8 p.m. ET, for America’s Last Digital Leap, and learn all about the early-stage company at the center of this $11.9 trillion revolution…

I hope to see you there!

Jeff Brown

Editor, The Bleeding Edge