Even Amazon founder Jeff Bezos invested billions of dollars in the most infamous initial public offering (IPO) of the dot-com bubble.

In 1999, Amazon took a 50% stake in Pets.com. At the time, its stake was worth $10.5 million.

With just a few clicks, Pets.com allowed customers to order pet products and have them shipped directly to their doors.

Amazon believed Pets.com would corner the online market for pet supplies. But the idea came a decade too early.

Much of the technology needed to execute this vision – cloud computing, data analytics, and digital marketing – didn’t exist yet.

After a year of hoopla – including a $1.2 million Super Bowl ad in 2000 – Pets.com went bust. And Amazon’s 50% stake in the company went up in smoke.

Fast forward a decade later… That’s when Chewy got its start.

Chewy’s vision is nearly identical to Pets.com. It’s an online pet store that delivers products right to your door.

But unlike Pets.com in 1999, when Chewy launched in 2011 it had easy access to the technology it needed to run an online pet marketplace.

Chewy didn’t have to hire developers for its cloud computing, data analytics, or digital marketing needs. It could just contract for those services.

That meant Chewy could focus on what it does best: selling pet products.

From its IPO in June 2019 to its peak in February 2021, Chewy saw a return of 440%.

Today, its market cap is $20 billion, and it generates nearly $10 billion in annual revenue.

Here’s why I’m telling you about Pets.com and Chewy…

The Key Metric Everyone Is Missing

During the dot-com bubble, there were countless failed ideas like Webvan, Boo.com, and eToys.com. At best, they were pipe dreams. At worst, they were rip-offs.

But some of these companies were simply ahead of their time – like Pets.com.

If you wrote off the entire tech sector because many companies flopped, you would’ve missed out on one of the greatest investment opportunities in history.

From October 2002 to November 2021, the tech-heavy Nasdaq grew over 1,300%.

Companies that emerged from the rubble like Amazon, Apple, and Nvidia made even greater returns of 62,200%, 77,587%, and 54,244%, respectively.

Many investors missed out because they thought the internet was a fad. They failed to see all the progress developers were making.

And there’s one key metric that shows how much progress a technology is making: the number of developers in the space.

These are the programmers, mathematicians, data scientists, and engineers responsible for pushing a technology forward.

If the internet was a fad, those developers would’ve been the first to pack up and leave.

But they didn’t.

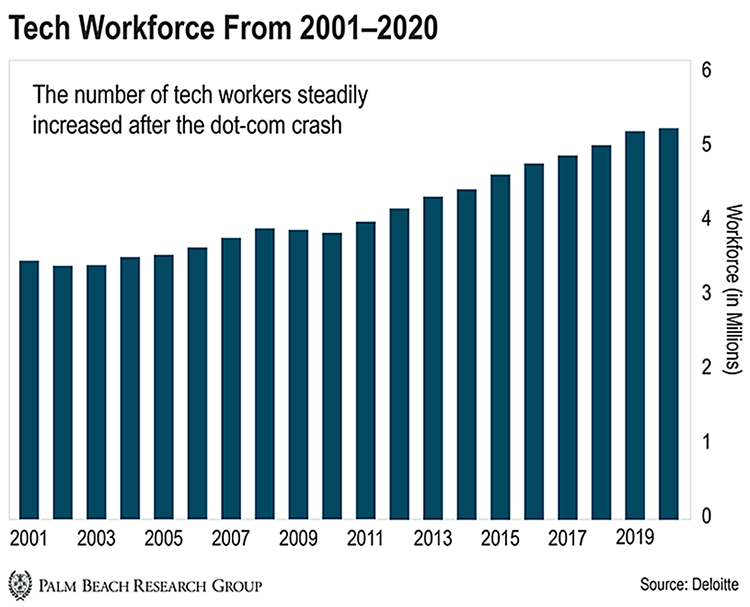

In fact, the number of tech workers increased in the years following the dot-com crash.

As you can see in the chart above, despite the 78% drop in tech stocks from 2000 to 2002 measured by the tech-heavy Nasdaq, the tech workforce remained relatively flat. And over the ensuing years, the number of tech workers continued to grow.

We’re seeing the same story play out in the crypto industry today.

Despite the current Crypto Winter, the number of developers working on blockchain and Web3 technologies has increased 5% since December 2021.

Like their internet brethren did in the early 2000s, blockchain developers are sticking around. And a great deal of them are on Ethereum.

Today, the total market cap of the crypto space is back to January 2018 levels… Yet monthly active developers have increased more than 297% over that same span.

Take a look at the next chart. It shows the pace at which developers are entering the space. As you can see, it’s still in a long-term uptrend.

Just like during the dot-com bubble burst, developers aren’t leaving despite the drop in crypto prices.

Those who are in the trenches working on the underlying technology and see the progress firsthand realize the potential that blockchain technology has. They know it will have a major impact on the world just as the internet did.

And when you look to see who takes the crown, no other network comes close to Ethereum. It has nearly 3x more developers working on it than the next.

Similar to the wider industry, the number of active developers working on Ethereum grew 5% last year, despite an 80% drop in the price of ETH from its all-time highs.

An even bigger eye-opener is when you look at how far Ethereum has come since the previous cycle’s top in January 2018. Since then, the number of developers actively working on Ethereum grew 5x, from 1,084 to 5,734.

And there are huge benefits to having thousands more developers than the next project pushing the technology forward.

More developers mean more apps. More apps attract more users. More users create a network effect. Because of the network effect, more users gravitate to your network.

Think of it this way…

There’s no value in a telephone network if only one person has a phone. If a second person gets a phone, the network becomes a little bit more valuable. But if everyone has a phone, the network becomes extremely valuable.

And Ethereum continues to be valuable…

Every major advance in blockchain technology since bitcoin’s inception in 2009 has gained traction on Ethereum – including DAOs, DeFi, and NFTs.

These are the upgrades that will take blockchain to the next level – just like cloud computing, data analytics, and digital marketing improved internet technology.

While other blockchain networks offer these types of apps, none come close to the success that Ethereum has achieved thus far.

Today, 60% of assets held in DeFi applications live on Ethereum. And roughly 80% of NFT trades by volume occur on the network.

This translates to more demand to use the Ethereum network than any other.

Ethereum generates roughly $2.4 billion in transaction fees each year. That’s roughly 10x more than the next blockchain network.

As you can see, Ethereum is solidifying itself as the go-to blockchain network for decentralized applications (dApps).

In the meantime, it’s also transforming itself into a multibillion-dollar income-generating machine.

The $40 Billion Income Opportunity

Next month, Ethereum will undergo its Shanghai upgrade. We believe this catalyst could send ETH’s token price higher as we head into the second half of 2023.

As we wrote earlier this month, the upgrade will give ETH stakeholders the ability to earn billions of dollars’ worth of income from the network.

As it stands today, Ethereum will pay out roughly $1 billion in income each year.

But in the future, we believe that number could swell to over $40 billion.

Despite the long-term bullish fundamentals, I know the current Crypto Winter has many people skeptical of crypto.

But buying crypto right now could be like buying Amazon for $6 after it fell 93% in the dot-com crash… You just need to know where to look…

That’s why Daily editor Teeka Tiwari recently held a special event called “Big T’s Final Call.”

During the event, he explained exactly what’s happening in crypto and shared details on a massive move we’ve never seen before.

You can watch a free replay of the event for a limited time, but don’t wait.

This will likely be the last bear market where we can turn small stakes into meaningful, life-changing returns… And there’s no time to waste.

Regards,

Houston Molnar

Analyst, Palm Beach Daily